Online Lending Software: checklist for your new system

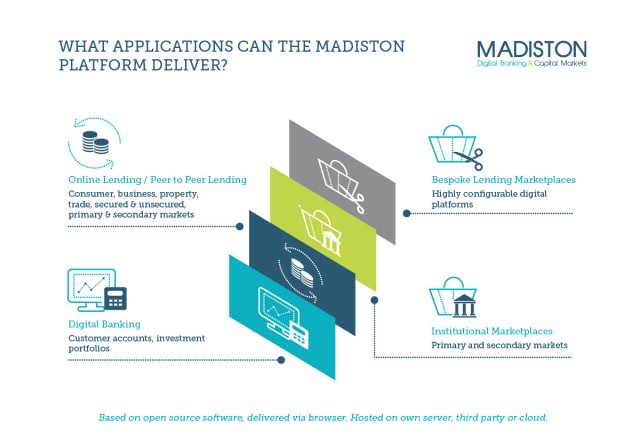

The lending landscape has changed and online direct lending, with many flavours from Peer to Peer Lending to International Institutional markets, being established. Whatever you're planning to offer your lenders (investors) and borrowers, what should you be considering when selecting your new digital lending software? Here is our checklist to help with your planning:

The basics :

For speed to market

Customisation services, licence, support, hosting and/or Software-as-a-Service (SaaS) or Platform-as-a-Service (PaaS) - all costs should be quoted up front and measurable.

Are the right markets available in the software for your Marketplace/Online Lending plans? Automated Primary/Secondary Markets for retail and Institutional Markets for on/off balance sheet lending.

Maximising liquidity

Your lending software should put you in control of your pricing, creating new lender products and setting borrower loan types, matching and moving funds quickly to maximise liquidity (no lender funds stagnating in unallocated silos).

Efficient onboarding

You will be looking for automated assessment, affordability and creditworthiness checks via a credit risk decision engine to ensure you capture the information required but deliver the best user experience.

Information at your fingertips

Are there document management/CRM facilities to give you the right information at the right time? Look for a systsem that stores documents, correspondence, notes etc that you need, with easy access via searches on various criteria including user name, loan ID, email type, etc.

The future:

Keeping up with a rapidly changing market

Configuration should be quick with settings to enable, disable or change functionality that you might want to include. For example: different customer profiles for individuals, companies or financial institutions, loan or investing product configurations and cash and client money management. Adding new products is key to keeping up in this market, so you should be able to change or adapt your settings quickly and easily.

Industry-wide changes - who bears the cost?

What happens when there are industry-wide changes to be made? Does your vendor include minor regulatory changes in their normal support updates? Are major industry-wide changes available on a shared-cost basis? In a young, evolving industry, this vendor option may save you significant sums of money over time.

Growing your business globally or with distributed ledger technology (DLT)

If you are looking to grow globally, then ensure your software can turn on multi-currency, multi-lingual facilities which are adaptable to different regulatory environments. Consider if DLT and crypto-currency accounts might be required in your plans going forward too. Will this become a direction of travel for the industry?

Conclusion:

Whether you are looking to buy or build your online lending software, one thing is sure, as soon as you launch it, you will want to change it! You will want to tweak the lending model, change the workflow or test a new market, like Salary Deducted Consumer Loans or Invoice Discounting perhaps. Change is inevitable, which can be expensive, so plan ahead carefully or buy a system with maximum inbuilt flexibility from the outset.

More information is available on madiston.com.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.