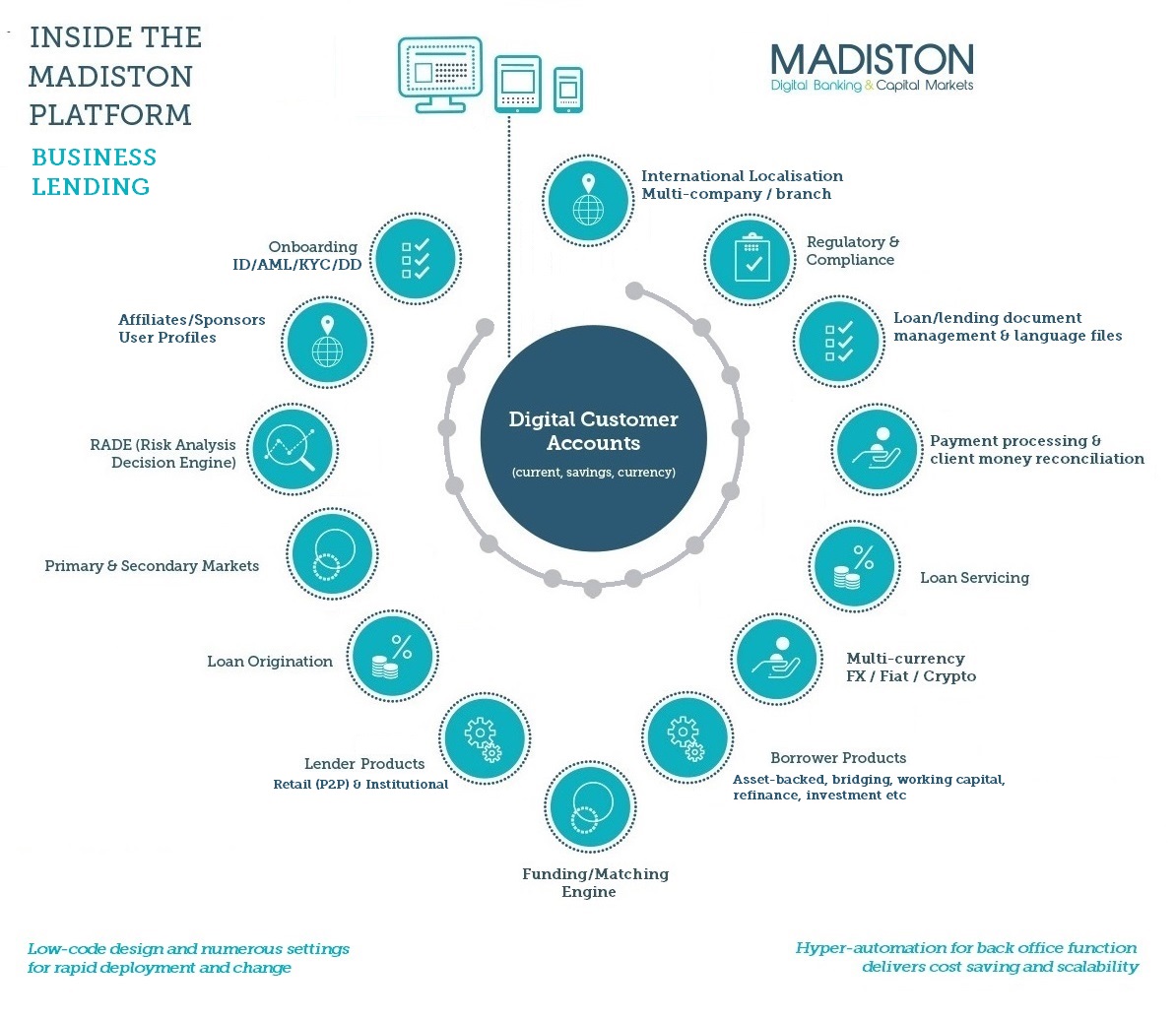

Madiston’s digital business lending software platform is a highly configurable, hyper-automated system for end-to-end loan processing. The design aim of the system was to automate as many of the processes as possible to free up your skilled people to manage the exceptions. Based on open source software, hosted on own server, third party or cloud, available via licence or software/platform-as-a-service.

Key Features inside the Madiston Platform for Business Lending:

- Loan Origination – businesses select their loan product and input relevant information including security offered. Madiston’s Risk Analysis Decision Engine (RADE) then uses credit history and other reference data to categorise risk for automated loan risk pricing.

- Secondary Market – optionally loan originators can refinance existing loans by offering them in part or whole to retail or institutional buyers.

- Loan Servicing – loan disbursal, automated processing of repayment collection and banking, management of late or missed payments, interface with third party collection agencies, and reconfiguration or part/full redemption of loans.

- Comprehensive Information Services – Business borrower dashboard for current loan information, automated customer email communications, market and regulatory information, statistics, charts, drill-down enquiries.

- Document Management – Store and retrieve all relevant correspondence and communications with borrowers registered on your platform.

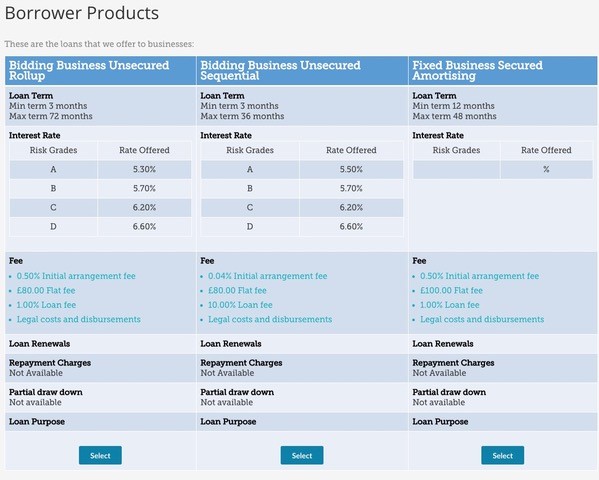

Additionally for marketplace business borrowing and lending:

- Visual Marketplace – fixed interest rate auctions or reverse auction bidding on loan requests by lenders competing to remain in the loan.

- Automated Marketplace – automated market, not visible on the site, where lenders set up their lending criteria (sector, credit-rating, interest rate, duration, etc) and their funds are matched with suitable business loan requests. The system can be configured to make available either the Visual Market or the Automated Market, or both.

- Lender funds matching – AutoLend enables lenders to flex their lending parameters to potentially improve interest rates achieved. EasyLend enables speedy automated lending without hassle or delay.

- Optional Reserve Fund Scheme – optional lenders’ reserve fund scheme to compensate lenders where borrowers miss repayments. Automatically calculates and processes reimbursements according to the settings and rules.

These are just a few of the features of our comprehensive software platform. Back office settings are configurable to mutiple business lending models and our development team can add particular requirements that are unique to your firm. To find out more or to discuss your particular requirements, please get in touch.