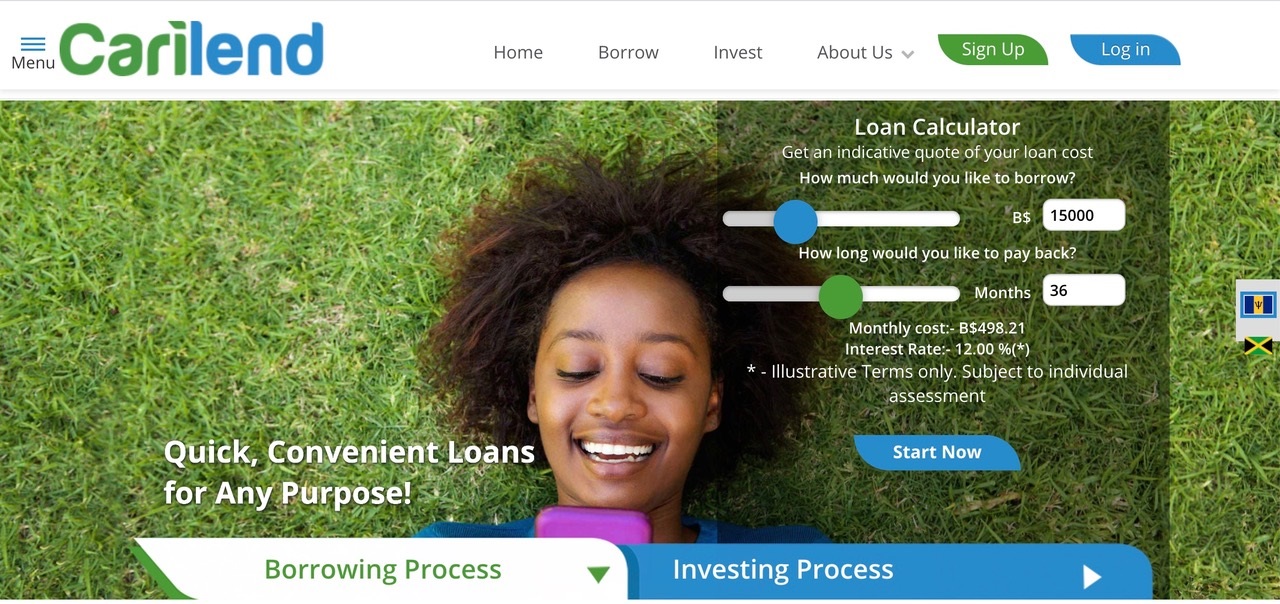

Madiston’s digital lending software supports institutional (balance sheet) and retail (Peer-to-Peer) lending models in the Caribbean for Carilend Barbados, Carilend Jamaica, Caribbean Lending Trinidad & Tobago including their partners Massy Finance, Victoria Mutual, Promotech and the Barbadian Government.